Exactly one year ago from today, I published a brief article covering Clearone Communications, Inc. (CLRO), which was a company I had recently purchased at the time. When the article was released, CLRO was trading right around $4 per share, and my cost basis was relatively the same. As you will see, CLRO's security price has appreciated quite a bit since then, and it now trades right above $8.00 per share.

(click to enlarge)

My original thesis behind investing in CLRO was a combination of several things, including its attractive valuation, management's history of adding value through acquisition, and simply its grow potential within the industry. Watching CLRO excel over the last year has really allowed me to reflect on my initial investment thesis, and overall, my thesis remained fairly accurate. While I was correct with respect to its intrinsic value being more than its market value at the time, CLRO's potential to quickly excel in the market was really what it had going for it. CLRO was a true growth candidate simply waiting to take off, and it did just so.

One year later, CLRO's operational performance has truly surprised me. Today, a number of its operating and valuation metrics remain appealing, which makes me wonder how much more upside potential investors can capitalize on in 2013. Regardless, over the next two years, CLRO clearly has room to continue growing, and its operations are more than capable of adding additional value for shareholders'. This article is going to provide a brief overview of its business model, highlight operating as well as financial performance, and conclude with several forward looking valuation estimates.

The Business

CLRO was founded in 1983 where it was incorporated in the state of Utah. Today, its headquarters remain in Utah, while its office are spread throughout the United States, Hong Kong, the United Kingdom, and Israel. As you may already know, its business model revolves around the design and development of solutions to enhance the feasibility of conference calls, collaboration efforts, streaming, and digital signage solutions for audio as well as visual communications. CLRO's end goal is to provide solutions to clients that offer a high level of functionality, ensure reliability, yet incorporate features that make these solutions user friendly. For reference, here's is two of CLRO's popular solutions, the "Collaborative Desktop" and the "Collaborate Room."

CLRO's line of conferencing products are catered to a wide variety of markets including individuals for personal use, premium packages for small businesses, and higher-end professional products for large corporations. At the end of 2012, CLRO's management announced that its operations control roughly 50% of the market share in the professional audio conferencing market for products used by large businesses. The large businesses and organizations that comprise this customer base include enterprises, healthcare, education and distance learning, government, legal, as well as financial institutions. The solutions provided across this segment not only save client's time, but serve to greatly reduce costs. Overall, the need for conferencing solutions is widely popular among large business in today's' world. CLRO has successfully penetrated the market up to now, and given its high level of continuous innovation, its likely CLRO will continue to penetrate this growing market even further in 2014.

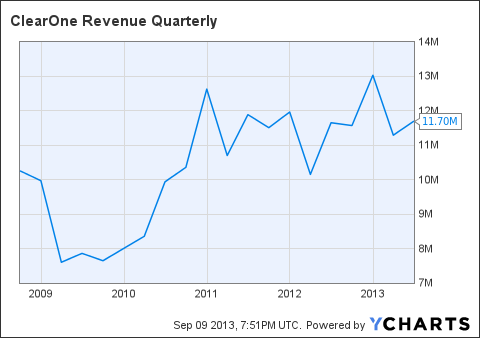

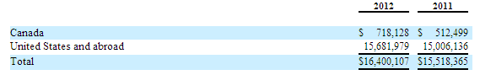

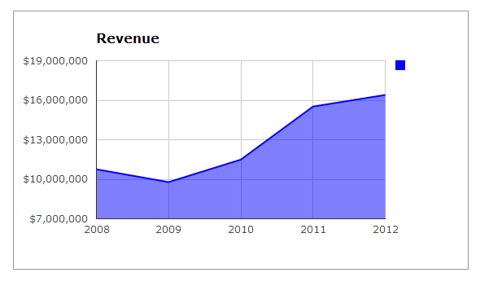

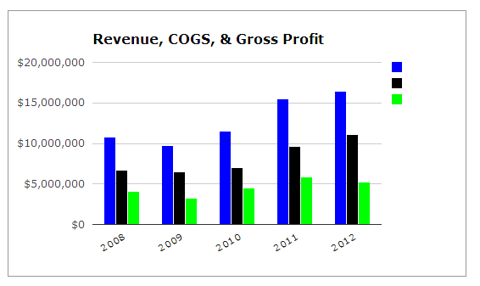

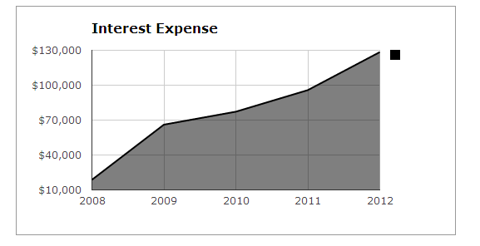

As you saw earlier, its share price experienced a significant increase YoY, and its revenue did as well. Let's take a look at CLRO's quarterly revenue growth over the last five years, but for the purpose of this analysis pay close attention its growth in the last two years.

CLRO Revenue Quarterly data by YCharts

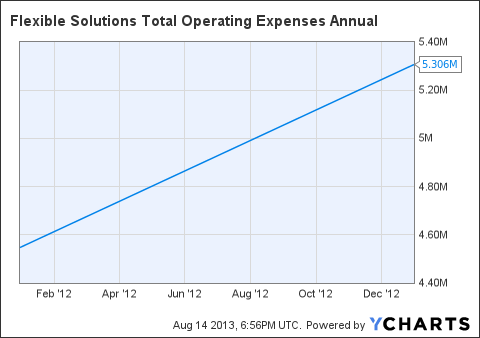

Since 2010, you will see that CLRO's revenue has really taken off. For year end 2012, total revenue came in at $46.42mm, and after expenses its net income was $26.65mm, which provided shareholders' with $2.89 in earnings per share. In my opinion, that's quite favorable from an investment standpoint. The primary reason for this is its operating expenses are typically fairly low as it is, and were extremely low for 2012 in particular. Total operating expenses in 2012 were only $3.90mm, which made its operating margin pretty attractive at almost 92%. Looking forward, I anticipate CLRO's revenue to be substantially higher than what it came out to for 2012. On a quarterly basis, revenue for 2013 has already came out to $11.29mm and $11.70mm for Q1 and Q2, respectively. And typically, based on historical trends, its revenue tends to be higher in the last two quarters of each year. On the expense side, CLRO looks as if it will sustain an operating margin that's slightly lower as it continues to expand its business. However, from a profitability standpoint, its operations add sufficient value to still provide a feasible investment for shareholders'.

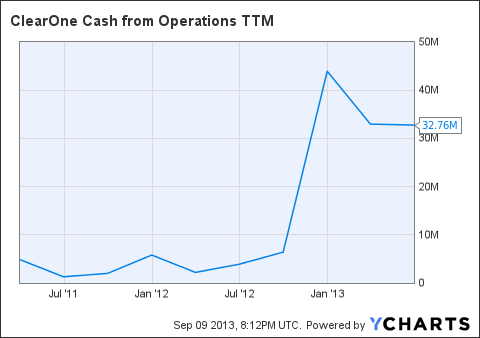

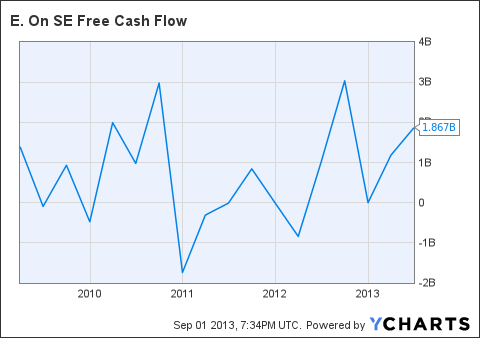

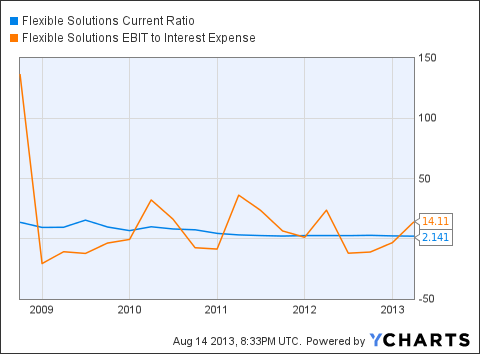

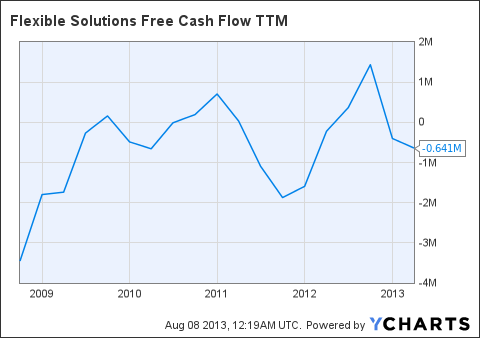

We've seen CLRO's ability to increase the magnitude of its business through sales growth, but its important we evaluate its earnings strength. Let's start by taking a look at its operating cash flow for the past couple of years. Its important to that CLRO's is currently in a growing stage, and in this stage, operating cash flow has a tendency to fluctuate quite a bit. However, on a positive note, you will see below that CLRO's cash flow generated by its operations has grown pretty well. Unlike net income, operating cash flow cannot be distorted with accounting shenanigans. Its a sign of real earnings and it's one sign the CLRO has the has the capability of sustaining its operations in the long-run.

CLRO Cash from Operations TTM data by YCharts

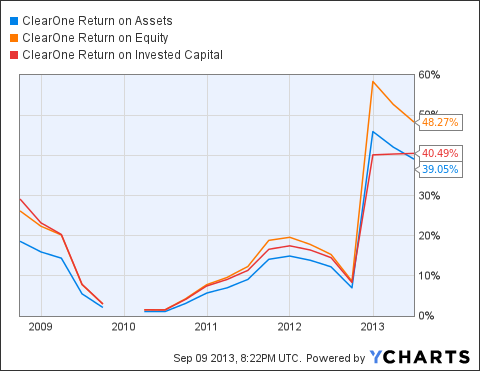

One more thing I would like to point out before getting into CLRO's valuation is its operating strength. In addition to its operating profit, all three metrics including its return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC) are substantially high. All three metrics are a solid indication of its ability to generate a return on capital invested into the company in different forms.

CLRO Return on Assets data by YCharts

Valuation

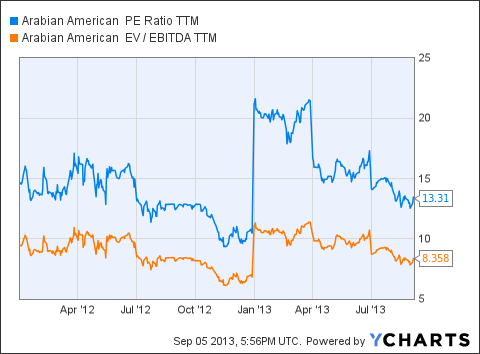

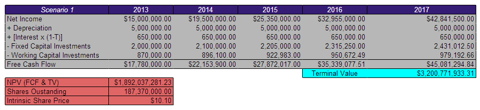

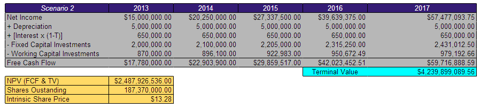

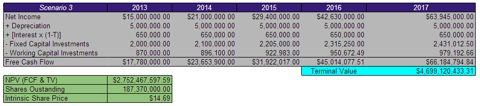

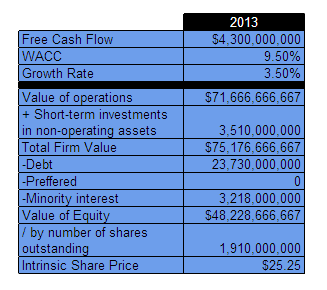

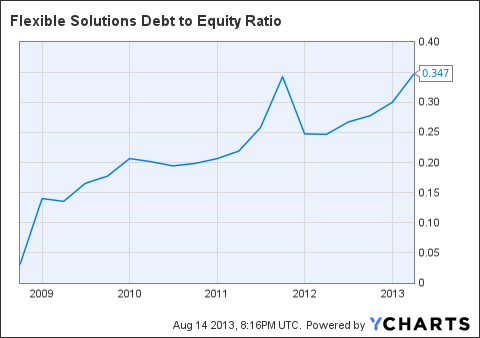

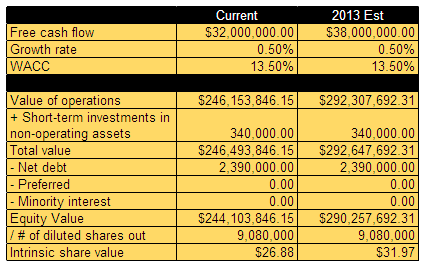

Given the recent fluctuations in CLRO's price, market price-based multiples such as the P/E ratio become rather difficult to use and make valuation a little tricky. I am going to use a variation of the corporate valuation model to provide investors with a current intrinsic share price estimate based of its current free cash flow trailing to maturity as well as a conservative estimate for the end of 2013. The inputs in the model are highly conservative and yield estimates that are quite favorable from an investment standpoint. But first, I would like to discuss CLRO's balance sheet and highlight several items that play a role in determining its intrinsic value.

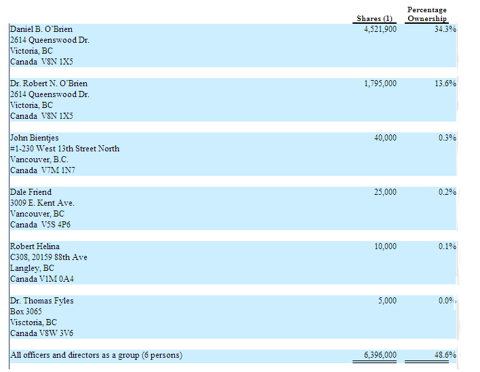

Over the last year, CLRO's balance sheet has improved quit a bit, and as CLRO continues to acquire more market share within the industry, the strength of its balance sheet is improving as well. First starters, its important to note that CLRO has zero long-term debt outstanding, and only liabilities on its balance sheet has decreased by more than 50% over the last six months. Right now, the total amount of liabilities on its balance sheet only $11.73mm, and of that total, $9.34mm is current liabilities including accounts payable, notes payable, and other short-term debt obligations. Furthermore, only $2.39mm of its total liabilities are long-term, and these are classified as other long-term liabilities. In order to provide an accurate estimate for its current intrinsic share price and a conservative estimate for the end of the year, I have included the amount of its other long-term liabilities under net debt in the model. I also modified several other of the inputs in the model to ensure the estimates are not far fetched, and when I am done, some of you may still beg to differ.

First, I started by making a slight adjustment to the figure I used for the risk-adjusted discount rank. As previously mentioned, CLRO has zero long-term debt and very few liabilities as it is. As a result, we can infer its capital structure is idea and of relatively low risk, however, this also produce an artificially low figure for CLRO's weighted average cost of capital (WACC). To counter this, I used the average WACC of several other firms in the industry, which is what CLRO's WACC would have been closer in the case it was slightly more leveraged in terms of debt. Next, I had to decide the amount of free cash flow to use for its current and year end estimates. For the current estimate, I used its free cash flow trailing to maturity, which came out to $32mm. For the 2013, I used an amount I projected based off of its expected operating cash flow for the next two quarters, and I arrived at $38mm. The last input that provided room for variation was the perpetual growth rate. And for this input, I used 0.50%, which is extremely low. Overall, the estimates used in the model were highly conservative, however the end results are shocking.

As you will see, the current intrinsic share price estimate is $26.88, and the estimate for the end of 2013 is $31.97. Although both estimates seem very unrealistic, this is the true per share value of CLRO's operating given its capital structure and the amount of free cash flow its operations have generated. One of the main reasons CLRO continue to remain deeply undervalued is the overall lack of knowledge among market participants. Being a small capitalization company, its incredible easy for CLRO to stay under the radar. However, its only a matter of time before its businesses expansionary measures take effect, and force investors to recognize its solid business model. Looking forward, I anticipate CLRO's operations to continue growing. And while these intrinsic share estimates may be a year or two away from being priced into the market, its operations sustain a much higher market value than the current $8 per share.

Bottom Line

The bottom line is CLRO is a small capitalization company with one of the best reward to risk opportunities I have seen in a while. Typically, with small capitalization companies there are many unusual risks that normal companies are not faced with, however with CLRO, that is not the case at all. CLRO's operation generate a sufficient amount of operating cash flow, and given the low level of regular capital expenditures, there is plenty of free cash flow available to the firm. Additionally, CLRO is in a unique, and rare financial position for a firm in its early growth stage. It has zero long-term debt on the balance sheet, and as I mentioned earlier, only $11.73mm in total liabilities, which are mostly current items that CLRO can easily fund through its high level of liquidity. In terms of market risk, its six month holding period returns reveal a beta of 0.60, which indicates its returns present a low level of volatility, and overall, make it an investment of relatively low risk considering the market has a beta of 1.

It's now easier to understand why its share priced doubled from its value a year ago from today. Going forward, I expect CLRO to gain further market share and generate a substantially higher amount of cash flow from operations along the way. The current market value of its operations is roughly $75mm, and given the estimated intrinsic value of its operations right now is closer to $250mm, it would not be a stretch to see its total market value increase to $150mm over the next year. For investors, the reward clearly outweighs the risk in this situation, and it would not surprise me if CLRO's share price in the market was to double in the next year.

Sources: TD Ameritrade, FinViz, YCharts, CLRO's Company Website, Google Finance, Yahoo Finance, Morningstar, and sec.gov.