Energy Services of America (ESOA.OB) is a beaten down company operating in the equipment and services industry for natural gas and through potential growth prospects presents a speculative buying opportunity that has the potential to provide shareholders with abnormal terms. Negative sediment surrounding ESOA is prevalent given the historical business risk associated with its operations, however after being transferred to the pink sheets where it now trades under a different ticker, volume recently dropped to an all time low as the security's market value per share did the same. The average volume traded per day remains stagnant, but it is progressively beginning to increase. This article begins with a broad overview to ESOA's business model and focuses heavily on its operations providing investors with the keen details needed to understand what is essential for ESOA to continue growing as a firm. In addition, this article will outline ESOA's capital structure breaking down its sources of debt as well as the condition and ownership of its common equity outstanding. To conclude, investors will be provided with several forward looking valuation metrics as well as qualitative and quantitative firm specific risk factors investors need to take into account.

Overview

ESA provides contracting services for energy related companies. Its services include installation, replacement and repairs of pipelines for the oil and natural gas industries, general electrical services for both power companies and various other industrial applications, installation of water and sewer lines for various governmental agencies, and various other ancillary services. In addition, ESOA also provides services for liquid pipeline construction, pump station construction, production facility construction, and other services related to pipeline construction. ESOA currently has 602 employees serving customers that are primarily located in the Mid-Atlantic region in states such as West Virginia, Virginia, Ohio, Pennsylvania, Kentucky, and North Carolina. Note these are the most common areas in which ESOA operates and that it does operate nationwide. Here is a specific list outlining a few of ESOA's customers:

- Spectra Energy

- Dominion Resources

- Columbia Gas Transmission

- Columbia Gas of Ohio and Pennsylvania

- Nisource

- Marathon Ashland Petroleum LLC

- American Electric Power

- Toyota

- Hitachi

- Kentucky American Water

- Equitable Resources

- Markwest Energy

- Range Resource

It is important to note that due to the seasonal impacts on ESOA's operations activities such as laying pipeline often does not occur during winter months, therefore not all of the customers listed above can be classified as year-around customers. In order to provide services to its customers, ESOA operates through its wholly owned subsidiaries including:

For additional information pertaining to ESOA and its subsidiaries please visit ESOA's company website or click on the link above corresponding to the individuals subsidiary of interest.

Relative Performance & Competitive Environment

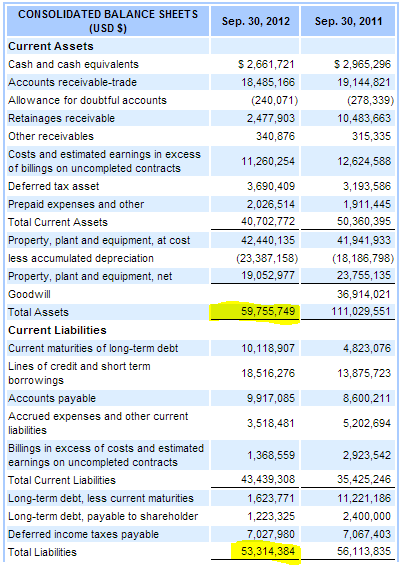

As you will see below in figure 1, following the credit crisis in 2008/2009 ESOA's market value per share fell dramatically and has remain relatively stagnant since. ESOA is currently trading at the bottom of its valuation and in terms of a value play by definition it would be a buy, however substantial debt outstanding and low levels of profitability merely make this stock one to watch in the short-term.

Figure 1: ESOA's Relative to S&P 500

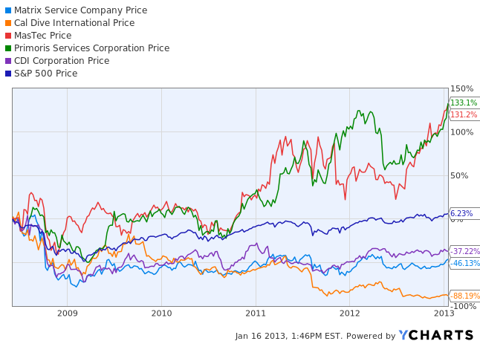

To illustrate the performance of ESOA's peers relative to the S&P 500 over the past five years, I used YChart's custom graphs. The companies used in this peer analysis include Matrix Service Company (MTRX), Cal Dive International (DVR), MasTec(MTZ), Primori Services Corporation (PRIM), and CDI Corporation (CDI).

Figure 2: ESOA's Peers Relative Performance

As I have illustrated, you will clearly see that ESOA operates in an industry that is highly competitive in nature. The companies I have outlined in figure 2 above are only a few of ESOA's peers. The high level of competition derives from optimal financing strategies that require high maintenance costs and abnormally high levels of capital adequacy to fund operations. In addition contracts for pipeline are typically awarded through a competitive bid process.

Backlogged Work Still Exists, But Improvements Are Underway

By analyzing ESOA's 10-K for the end of FY 2012, it is clear the substantial amount of backlogged work can be attributed to the negative decline in ESOA's profitability and significant downfall in market value over the course of the past year. According to ESOA's 10-K, as of September of FY 2012 there was approximately $57.4 million dollars in work to be completed on existing contracts outstanding, which is comparably less than the $128.5 million in backlogged work for the previous year at this date. Note ESOA's backlogged work represents contracts for services that have been entered, but have yet to be commenced. One reason for this is mentioned by ESOA's management:

"Due to the timing of ESOA's construction contracts and the long-term nature of some of our projects, portions of our backlog may not be completed in the current fiscal year."

The primary reason for this has to do with the ESOA's average duration in terms of how long it takes to complete a project from time the contract is initiated to the time it is ended. The majority of ESOA's projects can be completed in a relatively short period of time with a project lifespan ranging from two to five months. Larger scales projects can take upwards to 18 months to be completed. One of the key issues ESOA's encountered over the past year was unforeseen weather condition, which ultimately served as a barrier delaying the completion of existing and start of new contracts.

Capital Structure

Another area of concern that has significant implications on ESOA's ability to complete projects is its capital adequacy, basically the working capital available to fund projects. Its primary source of debt derives from its $18 million line of credit with a regional bank and under a Forbearance Agreement ESOA has agreed to a 6.5% interest rate on the principal outstanding during this period. The Forbearance Agreement between ESOA and its lenders was established and made effective on November 28, 2012. The primary disadvantage of this agreement is it prevents ESOA from making additional draws on its revolving line of credit. In addition, as stated in ESOA's 10-K the major covenants governing this line of credit are:

- Its current ratio cannot fall below 1.5.

- Debt to tangible net worth must not exceed 3.5.

- Capital expenditures must not exceed $7.5 million per year.

- Dividends shall not exceed 50% of taxable income without prior bank approval.

This Forbearance Agreement may be terminated upon certain evens and in any case on May 31, 2013. The termination of a contract as such would have a dramatic effect of ESOA's ability to complete projects. Primarily, it would restrict its working capital available to allot to unfinished projects. ESOA has the potential to receive a separate forbearance line of credit, if it were to apply and be accepted, however taking into account ESOA's current level of profitability and capital structure this not highly plausible.

An additional concern I have underlying the Forbearance Agreement is in regards to its subsidiary S.T. Pipeline and is clearly written in its 10-K:

"The Forbearance Agreement, among other things, requires that we close our S T Pipeline subsidiary and dispose of its assets."

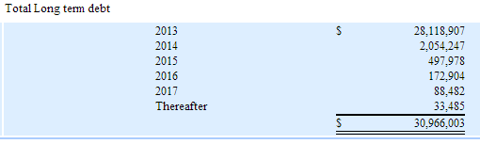

For an easy reference, here is ESOA's long-term debt outstanding listed in order of maturity.

Figure 3: ESOA's LT-Debt Maturities

Off-Balance Sheet Risk

In terms of off-balance sheet items investors need to be aware of ESOA's practice of lease financing and its concentration of credit risk that derives from customer transactions. In practice, it common for firms to exclude short-term financing for items such as leases from the balance sheet, however ESOA excludes several long-term items as well.

ESOA has various leases that are not capitalized and therefore are not reported on its balance sheet. These leases are specifically to help ESOA obtain equipment, vehicles, and facilities that are depreciable in nature and serve little benefit if purchased for long-term use. ESOA first lease obligation consists of two pieces of real-estate under-long term agreements extending through August 15, 2014, which require monthly rental payments of $5,000. ESOA's second lease agreement is for its headquarters office and requires monthly payments of $7,500 with an option to renew expiring October 2013. ESOA's last lease agreement is for its office and shop space requiring monthly payments amount to $11,800.

ESOA's level of internal credit risk revolves around and in entirely dependent upon the credit extended to customers. These lines of credit are extended to customers under normal payment terms, however it is typically unsecured credit meaning its extended without any form of collateral to back it up.

Valuation

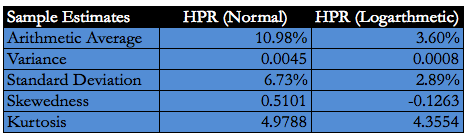

ESOA is highly leveraged in terms of its debt financing and unfortunately is highly associated with the significant decline in its security market price as has been clearly priced in. ESOA's current market capitalization is roughly $7.95 million, which is slightly more than the book value of its stockholders' equity on its balance sheet for the period ended September 30, 2012. Highlighted below in figure 4, you will see total assets were $59,755,749 and total liabilities $53,314,384. The difference between the two equates to only $6,441,365. In contrast to previous years you will see the difference between its assets and liabilities was significantly greater. This can be attribute to the $36,914,021 in "Goodwill" that was no longer deemed to have any relevance. According to ESOA's 10-K, "Based on our continued operating losses and management's forecasts of future cash flows our goodwill impairment test indicated that the goodwill of the Company had no value."

Figure 4: ESOA's Balance Sheet Value

Firm Specific Risks: Quantitative & Qualitative

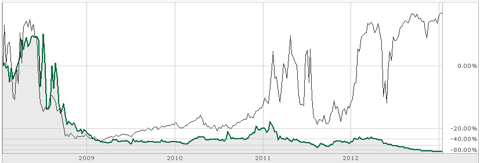

Despite ESOA's significant decline in its market value per share, historical patterns of volatility are relatively low. ESOA reveals a firm-specific beta value on only 1.27, which is slightly above the market beta level of 1.0. To analyze ESOA's firm-specific risk, I used its holding period returns with distributions for approximately the past six years (2006-Present) in order to compute the sample estimates above in both normal and logarithmic form. For accuracy and effort towards eliminating error in computing the sample estimates, I used the same methods in all calculation and retrieved equivalent data with identical number of observations.

Figure 5: ESOA's Risk Metrics

In figure 5, notice the variation between ESOA's sample estimates for the HPR (normal) and HPR (logarithmetic). The deviation between theartihmetic average for both computations is quite significant. ESOA's normal arithmetic average return for this period was 10.98% where as the logarithmic return was 3.60%. Note "Arithmetic Average" was computes using weekly data and therefore has been adjusted to represent the annualized return for both HPR normal and logarithmic. Also note the logarithmic HPR was first computed by deriving the relative return for each individual HPR, which is simply (HPR+1). This ensures all values are positive prior to computing the logarithmic value of each number. The standard deviation, simply the fluctuation in percentage terms of the securities market price per share on a time noted basis, is high at 6.73%. This is high in contrast to an average market index fund, which would be approximately 1.5% over the same period, however taking into account the industry in which ESOA operates this is merely a small area of concern. Engaged in an environment where a competitive bid process is used regularly to gain customers for contracts indirectly will augment this value. The kurtosis value revealed in ESOA's holding period returns does not surprise me given its historical trend, however it is an area of concern. Kurtosis is useful in determining the degree of peak in a distribution to help determine the likely hood of extreme outcomes. To some this simple computation may appear to be an obscure measure with little importance, however it was the failure to analyze metrics as such that results in failing to recognize the extreme probability of an even such as the 2008/2009 credit crisis from occurring.

In addition to the quantitative risk metrics involved with ESOA, there are firm-specific qualitative risk factors that need to be assessed as well. As I previously mentioned, I addressed concerns regarding ESOA's backlogged work, issues resulting from an inadequate capital structure, and several off-balance sheet items, but the core firm-specific risk facing ESOA is its working capital available. Excluding adverse weather conditions, the other primary factor affecting ESOA's operations its capital available to complete projects and this is clear through its history of backlogged work. Going into FY 2013, it will be imperative ESOA seeks alternative methods of financing in order to be capable of sustaining operations.

Conclusion

ESOA is a company if given the appropriate changes to its capital structure and financing decisions has the ability to make a turn around in the industry. Capital adequacy for funding projects and complications surrounding debt financing are the key underlying issues that initiated a sell off by market participants with high uncertainty. In conclusion, ESOA is a speculative investment that needs critical attention as it has the potential to provide investors with magnified gains, however substantial down side risk is prevalent with any firm that is not turning over a profit.

Sources: TD Ameritrade, YCharts, Google Finance, Yahoo Finance, and The US Securities and Exchange Commission Website.

No comments:

Post a Comment