So far, I have written about Arabian American Development Company (ARSD) a couple of times, and as I expressed before, it is definitely a company that deserves far greater attention in the market than it currently receives. My first article outlined seven reasons why ARSD is a solid buy, and the intent of my second article was to articulate why ARSD deserves a significantly higher market valuation. Since the publication of these two articles, ARSD's share price experienced slight appreciation breaking the $10 mark; however, it has still failed to reach its intrinsic value. Furthermore, its share price recently experienced a strong pullback, and now offers an excellent entry point for investors who would like to capitalize on a feasible growth company. Today, I am still surprised that with the elaborate nature of ARSD's operations, the company's business model remains vague and unknown by many market participants. And although ARSD's operation commands a significantly higher market valuation, the overall lack of transparency, specifically investors' awareness and knowledge of general information about the company remains the primary reason its stock price receives the attention it does.

From an operational standpoint, ARSD's performance is sound. Its operations sustain the ability to generate real earnings, which can be seen through adequate levels of operating cash flow. In terms of stewardship, its management is highly dedicated and exhibits a high degree of financial discipline through its ability to maintain a very low amount of debt, yet has the capability to fulfill any funding needs. To top that off, the combination of the high demand displayed by its end consumers along with the lucrative resources at its disposal place growth potential far above its competitors. Without a doubt, ARSD"s common shares have the potential to trade at easily 3-4x current market valuation from now. In this article, I will place a greater emphasis on growth potential to derive from ARSD's 37% interest in the AL Masane Al Kobra Mining Company (AMAK), which is a mining company in Saudi Arabia. Additionally, I will elaborate on its extensive customer base that feeds directly as the end consumers of both the resources retrieved from AMAK as well as the specialty petrochemical products manufactured at its in-house production entity known as South Hampton Resources. Finally, I will provide investors with a scenario analysis revealing its valuation in several different cases, and to conclude, I will address a few of those concerns investors may have going forward.

ARSD's Most Lucrative Growth Prospect Is Not Well Known

As many of you may already know, ARSD is a basic materials company specializing in the manufacturing and sale of specialty petrochemicals. For this segment of its business, its operations are conducted entirely in-house at South Hampton Resources. South Hampton Resources is ARSD's 115 acre facility in southeastern Texas, and also serves as the company's headquarters. Even though ARSD did not become incorporated until 1967, the early development of its petrochemical business originated at this very same location in 1955. With over 60 years of experience, ARSD now serves its customers as an industry leader and is capable of providing a large degree of flexibility for satisfying the demand for goods that are highly specialized in nature.

At the moment, the real value being added to ARSD in a material form on the income statement primarily derives from the divine need for these specialty petrochemical products. However, ARSD's vested interest and ownership in mining properties outside of the United States is a critical part of its business that will be the ultimate source of value in the future. Overall, I feel this aspect of its business is not well known. These properties are rich in terms of resources, allow for enhancements on the profitability side, and position ARSD in an excellent position for future growth in years to come.

One of ARSD's largest projects, and the most lucrative in my opinion, is the Al Masane project. This project is located in Saudi Arabia and is being conducted by the Al Masane Al Kobra Mining Company (AMAK), which is a closed joint stock mining company that ARSD owns 37% interest in. This company was formed with the combined effort of ARSD and eight individual Saudi investors. Today, AMAK specializes in the commercial production of copper and zinc concentrate. For reference, here's an image of the facility and the surrounding property.

In addition to the facility you see above, the ongoing Al Masane project covers 44 square kilometers in southwestern Saudi Arabia. The rights to this amount of land was issued through a 30 year lease agreement with the Saudi government that was commenced in May of 1993. With ten years remaining in the lease agreement, there is quite a length of time for ARSD to continue utilizing the resources that exist on this land. In a worst case scenario, the lease contains a renewable option allowing for an extension for any period up to 20 years. Overall, AMAK has provided a large amount of diversification to ARSD's operations, and has also provided the company with the luxury of being able to engage in exploration work in other areas discovered in Saudi Arabia.

Going forward, it's critical that investors not only keep a close eye on the aggregate outcome of the project, but specifically the output of resources along the way. Therefore, as the project begins to provide a return in excess of the capital invested in the project, investors should expect a dramatic spike in profitability. Most likely, this will occur in a specific quarter fully at once, but the beginning signs of it should be translucent enough to gauge along the way. The profitability enhancement from this project will add tremendous firm value in the long run. Furthermore, management at ARSD and the Saudi investors have already expressed interest in taking AMAK public, and decided that will not take place until at least two years after the Al Masane project begins turning over a significant profit.

The second resource ARSD has is a large chunk of interest (55%) in PEVM. Right now, PEVM is an inactive corporation, but the ownership of this includes rights to 48 patented and 5 unpatented claims, which totals to approximately 1,500 acres. The claims are all located in Lincoln County, Nevada. Following a revaluation of these assets, a write down just shy of $500,000 was recorded as impairment in 2008, and since, there has been no additional write offs for impairment. Overall, ARSD's interest in PEVM is not by any means comparable to its stake in AMAK, and management has already stated they have no intentions of further developing these mineral properties. So from a shareholders' standpoint, PEVM's only relevance is simply the underlying asset value of this ownership, which down the road can be sold to generate additional cash if need be.

A Growing Customer Base That Prospers From Brand Names

Generally speaking, it's common for high margins to derive from brand names. ARSD's customers thrive off brand names. Therefore, as a whole, ARSD's margins will continue to rely on the reputation of the large assortment of brands used by its customer base. ARSD's specialty petrochemical products are directly sold to a number of large, yet well-known public as well as private companies based in the United States. Just for reference, some of these companies include Exxon Mobil (XOM), DuPont (DD), 3M (MMM), Dow Chemical Company (DOW), Baker Hughes (BHI), Dart, NOVA Chemicals, Chevron Phillips, Imperial Oil (IMO), Calumet (CLMT), Advance Romantics, Chevron (CVX), and Lyondell (LYB). Here are a few more:

From the standpoint of these companies, ARSD is a critical supplier. With the combination of the unique attributes of these products and the high degree of specialization, ARSD's customer base is not willing to settle for lower quality. In most cases, its customers have a brand name to uphold, and preserving the reputation requires using ARSD's specialty petrochemical products. Over the years, the relationship ARSD has enriched between its customer base is an intangible asset of its own. ARSD is in a vital position to continue growing, enhance profitability, and overall, simply continue operating as a long-term supplier for its customers. Overall, ARSD's business model incorporates a large amount of sustainability internally, which is critical for generating profits in the long run.

Valuation

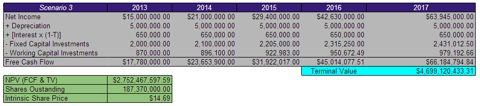

Over the last two years, ARSD's share price has fluctuated quite a bit, which makes price multiple based valuation techniques seemingly difficult to apply at times. However, to just paint the big picture, I have provided a graph illustrating the fluctuation in ARSD's P/E ratio as well as its EV multiple for the past couple of years. Below, you will see that ARSD's current P/E ratio is right around 13.31x, which is slightly lower in contrast to the industry average. On the other hand, its EV multiple is right around 8x, which is relatively fair for the industry in which it operates.

ARSD PE Ratio TTM data by YCharts

In addition, ARSD is undervalued on the basis of its P/B ratio. Right now, its P/B ratio is extremely low at roughly 0.80. Ideally, ARSD is a company that will approach fair value when its market price reflects a P/B ratio closer to 1.5x. ARSD's primary competitor, Phillips 66 (PSX), consistently trades at a P/B of about 1.6x, which is perceived to be right around the industry average.

In order to place a fair value on ARSD's common stock for the end of 2013, I constructed a series of discounted free cash flow models using different scenarios to reflect the impact of using different growth rates. Each scenario is highly similar in nature, except for the rate at which net income grows. For the risk-adjusted discount rate, I used ARSD's weighted average cost of capital of 12%. Additionally, in computing the terminal value, I took into account a perpetual growth rate of 5%. And the last assumption I used was a corporate tax rate of 35%, which was used for computing the after-tax interest expense needed to derive the free cash flow estimates. As you will sell below, each scenario has been labeled from 1 to 3, which reflects the worst to best case scenario.

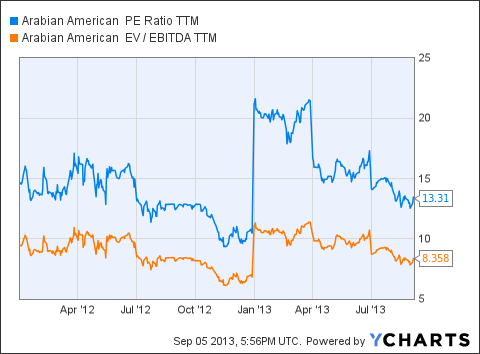

Scenario 1: The Worst Case, 30% NI Growth YoY

This scenario suggests an intrinsic share value of $10.10 for the end of 2013, which is roughly 29% higher than ARSD's current market value per share. I used this scenario for the worst case because I anticipate earnings to grow by at least this amount on average over the next four years. Realistically speaking, firms do not grow at the same steady rate year after year, and I do realize that. So I modeled two different scenarios where the growth rate changes, and as you will see, they tend to be on the more optimistic side of things. But overall, the worst case scenario still implies an intrinsic value that is above ARSD's current share price in the market.

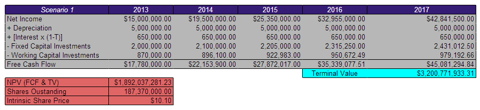

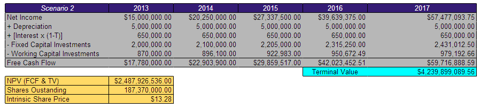

Scenario 2: The Mediocre Case, 35% NI Growth in 2014 & 2015, 45% NI Growth in 2016 & 2017

This second scenario reveals how a change in the rate at which its earnings grow can have a major impact on valuation. While the growth rates still remain conservative for a small capitalization company in its early growth stage, the intrinsic share price given the assumptions in this scenario is far more appealing than scenario 1. The intrinsic share price estimate for the end of 2013 in this scenario implies ARSD's fair value is nearly 70% higher than the market has priced it at, which I perceive to be fairly accurate.

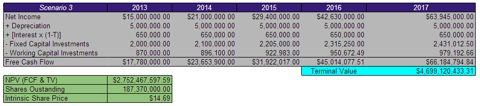

Scenario 3: The Best Case, 40% NI Growth in 2014 & 2015, 45% NI Growth in 2016, and 50% NI Growth in 2017

(click to enlarge) As you will see, not a lot has changed. The slightly higher growth rate used in the initial years had very little impact compared to the high growth rate in the final year. This scenario used three different growth rates, which in reality is far more accurate. The output of this model produced an intrinsic share price of $14.69, which is almost double ARSD's current share price in the market.

As you will see, not a lot has changed. The slightly higher growth rate used in the initial years had very little impact compared to the high growth rate in the final year. This scenario used three different growth rates, which in reality is far more accurate. The output of this model produced an intrinsic share price of $14.69, which is almost double ARSD's current share price in the market.

As you will see, not a lot has changed. The slightly higher growth rate used in the initial years had very little impact compared to the high growth rate in the final year. This scenario used three different growth rates, which in reality is far more accurate. The output of this model produced an intrinsic share price of $14.69, which is almost double ARSD's current share price in the market.

As you will see, not a lot has changed. The slightly higher growth rate used in the initial years had very little impact compared to the high growth rate in the final year. This scenario used three different growth rates, which in reality is far more accurate. The output of this model produced an intrinsic share price of $14.69, which is almost double ARSD's current share price in the market.

Overall, I feel ARSD's true value per share is best reflected by scenario two. Not only do I think its operations support a much higher valuation, but the fact its balance sheet contains hardly any long-term debt makes the company worth a lot more than market participants have priced in. Additionally, ARSD's management has always displayed high level of financial discipline and proven the ability to make decisions in the best interest of shareholders. Conclusively, I think ARSD's true value per share is about 60%-70% higher than its current share price in the market.

Final Thoughts

As we already know, ARSD is fairly well established in the marketplace as a supplier of specialty petrochemical products, and as a result, the level of competition remains minimal. The typical negative factors that source from a competitive environment among producers do not exist. Margin compression is irrelevant, operational performance does not suffer from a cost structure that's constantly changing, and ARSD has only one primary competitor including Phillips 66 . Basically, this allows us as investors to eliminate competitive threats as a major area of concern. Looking forward, it will be important to keep a close eye on its ongoing Al Masase project. This project will be a critical tool for adding firm value in the years to come.

Overall, ARSD is a strong company that is well positioned to be a high-growth candidate over the next several years. Its operations support a product that exhibits a high demand, yet is highly specialized. The level of customization adds reassurance making it extremely difficult for individuals among its customer base to "doctor shop" for what they want. On top of that, ARSD's management is dedicated and maintain a capital structure that is shareholder friendly with barely any debt. Based on its current level of earnings, I forecasted its earnings forward and was able to derive an intrinsic share price estimate for the end of 2013. Using the most conservative inputs, scenario 1 still suggests ARSD's true value per share is 30% higher than what the market currently reveals. Looking ahead, ARSD serves as an excellent investment for individuals with both short- and long-term investment horizons. Patient investors have the potential to capitalize on a 60%-70% return over the next six months.

Sources: TD Ameritrade, Google Finance, Yahoo Finance, sec.gov,ARSD's Company Website, FinViz, and YCharts.

No comments:

Post a Comment