Domtar Corporation (UFS) is a manufacturer, marketer, and distributor for a wide selection of fiber based products, including communication papers, packaging, and other specialty papers. Currently, there is a strong demand for pulp and paper products across the globe. And with only several firms serving the end consumers of the industry, the level of competition remains minimal. Domtar's sizable position in the industry's oligopoly market structure will enable it to maximize profits that are sustainable in the long-run. Additionally, this will augment Domtar's overall firm value as well as the intrinsic value of its common equity held by shareholders. This article will outline Domtar's business model, provide seven reasons why Domtar's a strong buy at its current valuation, and conclude with several investor concerns.

Domtar's Market Valuation Is Shrinking, But For No Reason

A notable decline in Domtar's security price in the market has recently made it an even more attractive value play. Earlier this year, Domtar was trading right above $80 per share. Looking at the graph below, you will see Domtar's security price declined by nearly 23% over the last six months.

Figure 1: Domtar's YTD Price Graph

Despite the decline in its price, Domtar remains a highly profitable company. Domtar's total revenue for Q1 2013 came in at $1.345 bn. After costs and expenses, this translated into net earnings of $45 mm ($1.29 EPS), which is significantly higher than net earnings in Q4 2012 and Q1 2012. Net earnings in Q4 2012 and Q1 2012 were $19 mm ($0.54 EPS) and $28 mm ($0.76 EPS), respectively. Overall, profitability has improved on a quarter over quarter and year over year basis. Arguably, there are substantial reasons for the recent decreases in Domtar's market value and it's clear that Domtar is trading at a severe discount to its fair value.

The Business

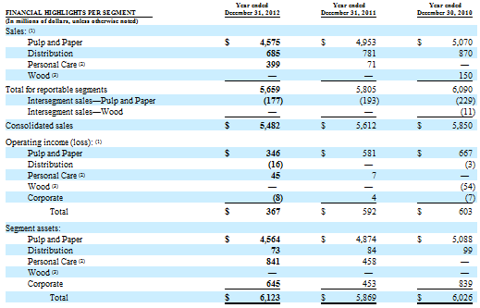

Domtar operates in three business segments including Pulp and Paper, Distribution, and Personal Care. The Pulp and Paper segment is by far Domtar's largest segment. On an annual basis, this segment alone produces nearly 4.2 metric tons of hardwood, softwood, and fluff paper. The vast majority of the pulp manufactured at these plants is distributed internationally to consumers who wish to manufacturer paper and other consumer products. In FY 2012, Domtar's revenue came in at $5.5 billion and the revenue from this segment alone was $4.4 billion, which equates to roughly 80%.

Figure 2: Domtar's Revenue Streams

In terms of manufacturing, Domtar owns and operates ten pulp and paper mills with an annual paper production capacity of approximately 3.4 million tons of uncoated free-sheet paper. Eight of the ten mills are located in the US and the remaining two are in Canada. Approximately 81% of its paper production capacity is in the US and 19% is in Canada. Domtar's paper manufacturing operations are sustained through 15 converting and distribution operations including a network of 12 plants that are located off-site of its paper manufacturing operations. In order to satisfy the demand of the end consumers in the market, Domtar produces market pulp in excess of its internal requirements at its three non-integrated pulp mills in Kamloops, Dryden, and Plymouth. On average, Domtar sells approximately 1.6 million metric tons of pulp per year. The estimate is subject to vary due to the market conditions.

The second part of Domtar's business is its distribution segment, which involves the purchasing, warehousing, sale and distribution of its various products and those of other manufacturers. These products include business, printing as well as publishing papers, and certain packaging products. These products are sold to a well diversified customer base, which includes small, medium and large commercial printers, publishers, quick copy firms, catalog/retail companies and institutional entities. Domtar's distribution segment operates in the United States and Canada under a single banner and umbrella name, Ariva. Ariva operates throughout the Northeast, Mid-Atlantic and Midwest areas from 16 locations in the United States, including 12 distribution centers serving customers across North America. The Canadian business operates in two locations in Ontario, two locations in Quebec, and two locations in Atlantic Canada.

Last, is Domtar's personal care segment. This segment is responsible for the manufacture and sale of adult incontinence products and disposable washcloths marketed primarily under the Attends brand name. Domtar obtained the right to market its products under the Attends brand name in 2012 when Domtar acquired Attends Europe. At the time of the acquisition, Attends Europe was a manufacturer and supplier of adult incontinence care products in Northern Europe. As a result of the acquisition, Domtar is one of the leading suppliers of adult incontinence products sold into North America and Northern Europe.

Seven Reasons Domtar's A Solid Buy Under $66 Per Share

#1 The unique attributes of the industry's oligopoly market structure will be a lucrative resource for helping Domtar remain a dominant player in the industry. On May 21st, 2013 Domtar presented at the Goldman Sachs Basic Materials conference in New York as the largest integrated marketer and manufacturer of fiber based paper products in North America. As mentioned earlier, Domtar competes in an industry with few competitors, which is one of the main characteristics of an oligopoly. In addition, other characteristics include high barriers to entry and product differentiation, which both exist as a feasible means for providing a high degree of specialization to meet consumers needs. However, the most lucrative attribute that will effectively benefit Domtar in the long-run is the leverage over pricing power oligopoly's provide. Given there are few competitors in the market and a low probability of any new firm succeeding in the market, Domtar has the ability to exert a large degree of pricing power in the market place. The consistent demand exhibited by end consumers for Domtar's specialty fiber products is inelastic and the majority of the consumers are companies that rely on these products for production. Therefore, Domtar has the capability of raising its prices to a certain degree and will still be capable of retaining its customer base. The ability utilize pricing power as such is rare and something that many firms will never have at their disposal. In the long-run, being able to leverage further control over prices can heavily influence margins and profits for the good of the firm.

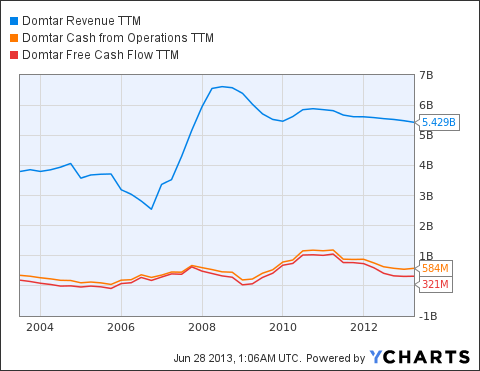

#2 Domtar's operating performance has a history of success, and more importantly -- stability. In the last ten years, Domtar's revenue has experienced quite an increase -- nearly 42% over the entire period. After 2008, its level of revenue has maintained relatively the same at an average of $5.5 bn per year. However, the story is not the same for its operating and free cash flow. Domtar's cash flow generated from operating activities has remained relatively the same over the past ten years. Even following the large revenue increase in 2007, operating cash flow exhibited little change. This can be attributed to substantial cash outflows for operating activities. With such a high level of revenue, there is no reason why Domtar cannot sustain a higher level of operating cash flows. Going forward, I anticipate cash outflows to decrease, which will help drive operating cash flows up. Overall, Domtar's displays excellent stability in its revenue. And based on its operating results in Q1 2013, Domtar will have no issue exceeding 2012's level of revenue and net earnings.

Figure 3: Domtar's Operating Performance

UFS Revenue TTM data by YCharts

#3 Investors are on track to benefit from a structural change to Domtar's variable operating costs. As you may have noticed in the graph above, there has been a sizable difference in the past between Domtar's cash flow generated from operating activities and its free cash flow available to the firm. The sizable difference can be attributed to a high level of input costs that are accounted for as capital expenditures. As noted in Domtar's Q1 2013 earnings report, management believes there will be a change in Domtar's variable costs next quarter:

"We expect continued momentum in pulp markets with moderate improvement in pricing and steady shipments. In papers, our volumes are expected to stay relatively similar to the first quarter in the near term. The second quarter will be affected by the usual seasonal higher maintenance activity in pulp, while input costs are expected to decline slightly, notably due to lower usage of energy."

A decrease in input costs will reduce the aggregate amount of capital expenditures, which will increase free cash flow as a result. Ultimately, we want to see free cash flow grow, but we also want the variation between operating and free cash flow shrink. And it appears the difference will shrink according to managements expectations for the rest of this fiscal year.

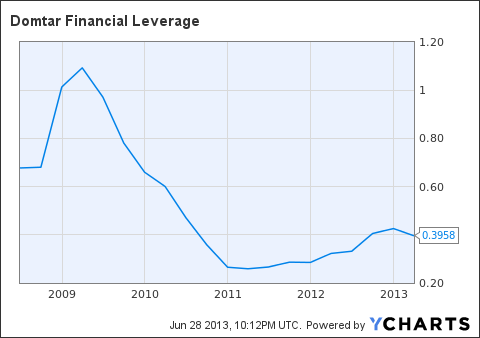

#4 Domtar's capital structure is adequate for its operations and its high level of solvency is perfect for sustaining growth in the long-run. Additionally, Domtar is not highly leveraged in terms of debt. Its current debt-to-equity ratio is only 0.40, which is significantly lower than its peers. As previously mentioned, Domtar is making slight changes to its cost structure. Although its current cost structure does not entail a high degree of financial and operating leverage, reducing input costs will help further reduce this risk. Let's take a look at Domtar's financial leverage:

UFS Financial Leverage data by YCharts

Financial leverage is an excellent measure that helps depict a firm's level of solvency. The degree of financial leverage tells us to what extent a firm uses fixed costs in its cost structure. As you will see above, Domtar's current financial leverage is significantly low, which is positive from an investment standpoint. In addition, I expect this number to decrease as the firm makes adjustment to its input costs.

#5 Domtar's valuation is attractive. The combination of basic metrics and other valuation multiples indicate Domtar is trading at a discount to its fair value. Below, you will notice Domtar average P/E ratio has been increased within the last two years. I expect this trend to continue and can easily see Domtar commanding a P/E of right around 15x, which is ideally where I would like to see it trade. Also, you will see that Domtar's P/B and P/S are extremely low and have displayed relatively little change over time.

Figure 4: Domtar's Basic Valuation Metrics

UFS PE Ratio TTM data by YCharts

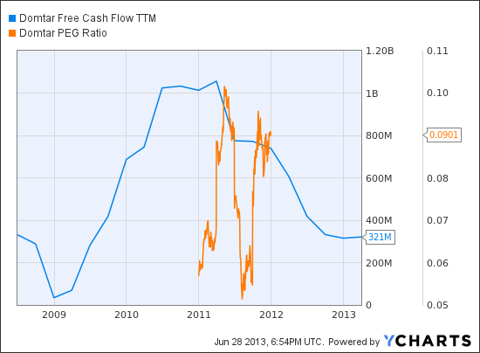

In addition, Domtar's level of free cash flow available to the firm and the growth rate of its earnings show Domtar's security price is clearly undervalued. Let's take a look:

Figure 5: Domtar's FCF TTM & PEG Ratio

UFS Free Cash Flow TTM data by YCharts

Currently, its free cash flow TTM is right around $321 mm. With 34.80 mm shares outstanding, its free cash flow per share equates to $9.22. Given its trading around $67 in the market, it price-to-free cash flow (P/FCF) ratio is approximately 7.26x. In addition, you will notice above that its price-to-earnings growth ratio is less than 1. The combination of a P/FCF ratio of less than 15x and a PEG ratio of less than 1 is a strong indication that the security is undervalued. And based on both of these ratios, we can conclude that Domtar is indeed undervalued.

#6 Domtar's relative strength index (RSI) indicator is suggesting there is a favorable probability that we will soon see a turnaround in its security price. After being heavily oversold this year, its current 30-day RSI indication is right around 29.75. An RSI between 20 and 30 indicates the security has been heavily oversold and that there is a high probability of an upward trend in its security price.

#7 Fifteen analysts that cover the stock have a median and mean price target of $86 and $83.67, respectively. The mean price target suggest an upside of nearly 26% from its current market value.

Bottom Line

Domtar's lucrative position in a niche market is perfect for increasing margins and sustaining long-run profits. Domtar's valuation is highly attractive and it is now a perfect time to initiate a position. However, before doing so, there are a couple things investors need to be aware of. As we saw, UFS is heavily dependent on its revenue from the Pulp and Paper segment of its business. Domtar has several revenue streams, however the fact its revenue is derived predominantly from one source is something that could negatively impact its performance down the road. At the moment, the demand for its products in the pulp and paper segment is consistent, and historically, it has been this was as well. Going forward, the probability of the end consumers maintaining a stead demand is high. However, there is always the possibility for this demand to diminish, and investors need to take this into account. Additionally, investors need to keep a close watch on Domtar's international business. There is a strong international demand for the material produced from Domtar's operations and a large portion of its end consumers are international companies. Although the market structure of the industry makes it highly difficult for a new firm to enter the market, the possibility of a foreign competitor entering the market to supply a differentiated set of goods is a possibility. Therefore, it is important that Domtar is consistently changing whatever is necessary to fulfill its customer needs. Investors can monitor this by analyzing sales growth on a quarterly basis. Overall, Domtar is an excellent company on sale for a bargain. Given its favorable valuation, its sizable position in the industry, and its potential to sustain profits in the long-run, I recommend investors buy Domtar at its current valuation.

No comments:

Post a Comment