ENGlobal (ENG) is a small capitalization company operating as a provider of engineering and various specialty services for companies within the energy sector. Despite the inherent volatility that's commonly associated with small capitalization companies, ENGlobal presents a different story. In terms of operations, its business risk is minimal and its growth potential is tremendous. Right now, its common shares offer pretty solid value as they continue to trade at a severe discount to intrinsic value. The suppressed valuation also provides investors with an adequate level of downside risk protection. Clearly, a feasible investment exists, but it's important to realize that it is only a matter of time before active market participants begin to exploit this simple market inefficiency. Within the next six to twelve months, I believe ENGlobal could see a substantial upside. An upside in excess of 100% is not out of the question. Actually, it's highly probable - and shortly, you will see why. This article will give an overview to ENGlobal's operations focusing specifically on its historical and recent performance. In addition, it will place an emphasis on its valuation and highlight the key differences between its market and intrinsic value investors need to be aware of. For a good primer, here's an overview of ENGlobal's business.

Background

EnGlobal was incorporated in the State of Nevada in June of 1994. Since, it has operated as a major service provider to its wide range of customers primarily concentrated in the energy sector. In terms of geographical placement, its operations are quite diverse and cover a vast landscape. As of the most recent reporting period, ENGlobal has roughly 1,700 employees in 15 offices located in six different states including Texas, Louisiana, Oklahoma, Colorado, Alabama and Illinois. For simplicity, ENGlobal's operations can easily be divided into two segments including:

The Engineering and Construction Segment incorporates all the services related to the development, management and execution of projects requiring professional engineering to the midstream and downstream sectors throughout the United States. According toENGlobal's 10-K, the services provided within this segment include the following:

- Conceptual studies

- Project definition

- Cost estimating

- Engineering design

- Environmental design

- Environmental compliance

- Material procurement

- Project and construction management

- Facility inspection

For this segment, the services listed above are provided to customers through one of its two wholly owned subsidiaries including:

- ENGlobal U.S., Inc.

- ENGlobal Government Services, Inc.

The ENGlobal U.S., Inc. subsidiary focuses on providing its services primarily to midstream and downstream segments of the oil and gas industry, chemical and petrochemical manufacturers, utilities and alternative energy developers. In addition, this subsidiary works on a wide range of energy infrastructure projects in the U.S. These projects entail services related to construction management, process plant turnaround management as well as plant asset management. TheENGlobal Government Services, Inc. subsidiary provides automated fuel handling systems and maintenance services to branches of the U.S. military and public sector entities. The customer base of this subsidiary includes government agencies, refineries, petrochemical and process industry customers around the world.

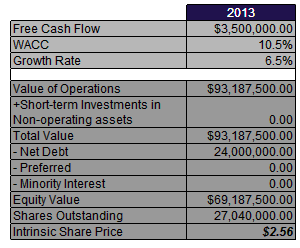

Overall, this entire segment is far more labor than capital intensive. With that being said, ENGlobal's operating performance is heavily dependent on its ability to generate revenue and maintain cash flows in excess of cost required to sustain its operations, pay employees and cover any additional SG&A expenses. In terms of revenue, the Engineering and Construction segment is by far ENGlobal's largest segment. The revenue generated from this segment derives from contracts. This segment has an existing blanket service contract which it provides clients with either services on a time-and-material basis or with services corresponding to a fixed-price that is agreed upon in advance. Typically, about three-fourths of annual revenue is generated from this segment. In 2012, 74.1% of its revenue was derived from this segment, which is the equivalent of $168.93 mm. Although the Engineering and Construction segment is ENGlobal's large source of revenue, its Automation segment was the only portion of its business to produce a positive operating profit in 2012. The combination of high operating costs and work pushed forward have not only increased the amount of backlogged work, but had a major impact on its 2012 operating performance.

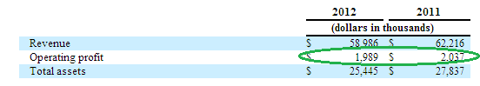

The Automation Segment provides services pertaining to the design, fabrication as well as implementation of process distributed control systems, analyzer systems, advanced automation, information technology, electrical and heat tracing projects primarily to the upstream and downstream sectors throughout the United States. In addition, this segment of caters to specific projects for customer needs in the Middle East and Central Asia. The automation segment only constitutes about a quarter of ENGlobal's total revenue. Therefore, the performance of this segment has a significantly smaller impact on ENGlobal's business as a whole. In addition, the growth in this segment is seemingly smaller than its engineering and construction segment, which is reflected by the decline in the proportion of its revenue from this segment from 2011 to 2012. In 2012, the revenue generated from this segment was roughly 25.9%. Below, you will see the decline in its revenue from 2011 to 2012.

(click to enlarge)

For both segments, we saw a decline in total operating assets on a year-over-year basis. The total assets for its Construction and Engineering segment decreased by nearly 33%, while total assets for its Automation segment only saw about a 2% decrease. Despite the large decline in total assets for its larger segment, the magnitude of this impact is still not significant enough to heavily influence ENGlobal's fair value. Going forward, I expect ENGlobal's Engineering and Construction business segment to experience the most growth in terms of revenue generated and return on capital invested in this segment of its business. Also, I anticipate the revenue generated from its Automation segment to remain relatively the same.

Switching gears for a minute, let's take a look at ENGlobal's performance in the market. As you will see below, its clear that the fair value of ENGlobal's operations is not by any means accurately reflected by its current price in the market.

In early 2011, ENGlobal's stock price took a nasty turn. At the time, its share price was right above $5, and now, ENGlobal trades at barely above $1 per share. In just a two-year period, its stock price managed to decline by 80%. But, the question is - why?

Earlier this year, management announced the discontinuation of one of its business segments - Field Solutions. The revenue generated from this segment was comparable to the revenue generated by the Automation segment. However, the Field Solutions segment was not growing. It was simply producing a negative operating profit and has been doing increasingly worse over the course of the last few years. While the discontinuation of this business segment had relatively little impact in the short-run, the capital that would have been used to sustain this business segment can now be utilized appropriately - to fund expansion.

Yes, ENGlobal's operations have expanded overtime. However, issues concerning capital adequacy and low levels of solvency have ultimately served as a deterrent preventing ENGlobal from developing any form of sustainability in regards to its operations. Low levels of capital available to fund projects has forced work to pile up, which overall has increased ENGlobal's aggregate amount of backlogged work. The discontinuation of its Field Solutions segment will fulfill ENGlobal's liquidity needs for reducing its backlogged work and improve its solvency position in the long-run.

Operating Performance Has Been Mediocre, But Is Already Showing Signs of Improvement

In addition to net income, it's crucial to look at the amount of cash generated from operations. By looking at operating cash flow we can determine whether a company is generating real earnings and eliminate the potential usage of accounting gimmicks that distort net income. But as you will see below, ENGlobal's performance in the last couple of years is nothing to get excited about. In fact, looking at its operating cash flow may seem almost useless given the unfavorable loss in net income for both years, 2011 and 2012. But shortly, you will see how this has already begin to change in 2013.

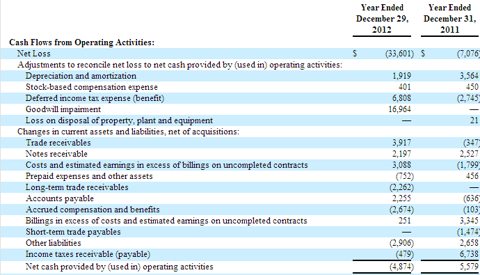

First, let's take a look at a portion of its cash flow statement for the past two fiscal years:

Clearly, ENGlobal's earnings did not improve from 2011 to 2012. Its level of operating cash flow went from positive to negative after reporting a loss on net income of nearly 5x more than the loss in the previous year. Furthermore, its operating cash flow for 2011 was barely positive. If you look closely at the cash inflow items for 2011, you will see the income taxes received for this year ($6.738 mm) made all the difference. The sole reason ENGlobal had positive operating cash flow of $5.579 mm in 2011 was because of the income tax receivables. Unfortunately, its historical earnings do not reveal the stability investors like to see, but it does provide some support for why ENGlobal was heavily sold off the way it was. Going forward, investors should expect to see major changes.

So far in 2013, we have seen the structural changes management made by eliminating one of its business segments. However we have yet to see the full economic value this decision has the potential to add. Besides the depletion of an entire business segment, the changes related to the costs associated with sustaining that segment are going to have the greatest influence. And ENGlobal's Q1 2013 financials are just beginning to show this. For Q1 2013, ENGlobal reported operating revenue of $49.763 mm. Its net income came out to $1.937 mm, which is the equivalent of $0.07 earnings per share based on the weighted average number of shares outstanding. Its important to note that the final net income figure reflects the loss from continuing operations and income from discontinuing operations, which as previously mentioned, the Field Solutions business segment. At the share level, the income from discontinued operations was $0.11 and the loss from continuing operations was $0.04, which combined equates to net earnings per share of $0.07. This is a significant improvement from the previous quarter as well as this same quarter the previous year. In addition, the improvement is revealed through its operating cash flow.

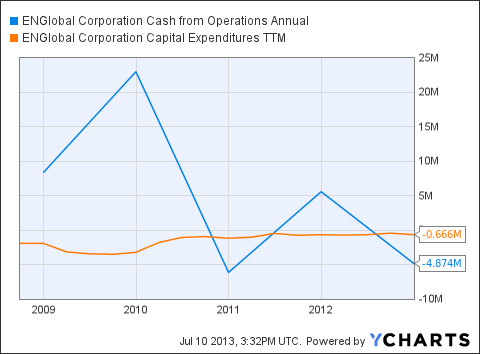

For Q1 2013, its operating cash flow came in at $5.89 mm. As you will see in the graph below, this is a dramatic change from the previous quarter where its operating cash flow was negative at $4.874 mm. The significant variation between these two figures can be attributed to the discontinuation of one of its business segments as mentioned earlier. Going forward, I expect ENGlobal to gain stability in its operating cash flow and sustain a positive level.

Other notable changes made in this quarter concern capital expenditures and changes in working capital. Capital expenditures saw a major decrease from roughly $670,000 to $20,000. On the other hand, working capital increased quite a bit to $6.34 mm from $2.63 mm.

Shareholder Base

ENGlobal's 27.4 mm common shares are primarily split between insiders and institutional investors. Nearly 44% are held by insiders while institutional investors account for about 28%. The remaining portion of its common shares are disbursed among private investors with a majority of them residing in the United States.

The Stock Is Dirt Cheap...

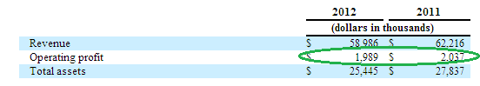

Valuing a company in either its early growth stages or rather small in terms of the magnitude of its earnings can be rather difficult. Additionally, it's important for investors to understand the absence of stable free cash flows can cause the inputs in present value models to produce variation within the results. Therefore, I am going to stay on the conservative side in regards to the inputs I use.

Below, you will see that I used the corporation valuation model to arrive at an intrinsic share price estimate for the end of 2013. Although this model does not incorporate free cash flow estimates extending beyond one year, I feel it provides greater accuracy given ENGlobal lacks a strong history of generating free cash flows. Let's take a look:

As a result, this model concluded with an intrinsic share value of $2.56, which suggests an upside of nearly 115% from its current price in the market. Note this model takes into account ENGlobal's current capital structure, which is reflected through its weighted average cost of capital (WACC) of 10.5%. In addition, I assumed its operations will grow at 6.5% over the next year.

Investor Concerns

As previously mentioned, for a small capitalization ENG presents relatively low business risk. In addition, the quantitative risk within its holding period returns is relatively low as well. Using its historical monthly holding period returns, I computed a firm-specific beta of only 1.83. But like any investment, we have to assume the worst and account for the probability of extreme outcomes. To ensure investors are ready to protect themselves in a timely manner from unforeseen events, there are several things investors need to bear in mind.

First, it's important investors understand that there is a moderate level of uncertainty surrounding future revenue and earnings. The extent to which this uncertainly will actually translate into a material impact on ENGlobal's operating performance heavily depends on the state of its backlogged work. As of December 29, 2012, ENGlobal's backlogged work was approximately $205.3 mm. Since December, the total amount of backlogged work has been reduced, however it's not certain that the remaining portion of revenue projected in backlogged work will be realized or not. In addition, ENGlobal's dependence on a few select customers has the potential to negatively impact its performance down the road. Last year, ENGlobal heavily relied on three customers including Caspan Pipe Consortium, the US Government and BASF Corporation. These three customers comprised 9%, 7% and 5% of its revenue, respectively. The loss of business from any of these customers could have an adverse impact on total revenue in the future.

Bottom Line

As you can see, ENGlobal is in a recovering state. Its operating margins reflect low levels of profitability and its cash flows are just starting to gain stability. The discontinuation of its Field Solutions segment enhanced its performance in Q1 of 2013 in terms of its net earnings, but its operating income on a standalone basis tells us ENGlobal has not recovered. The increases in its operating income will depend on management's ability to complete backlogged work and effectively maintain the level of outstanding work to a minimum. Liquidity has been a major issue in the past, but recent enhancements in this area eliminate this concern. As a result of the discontinuation of ENGlobal's Field Solutions segment, its level of solvency improved dramatically. The increased level of solvency will not only help reduce backlogged work, but more importantly, allow ENGlobal to sustain its operations in the long-run.

ENGlobal's performance will also rely on management's ability to effectively implement a new cost structure. While ENGlobal is not highly leveraged in terms of the fixed costs used to sustain its operations, maintaining an effective capital budget that monitors cash outflows to investing activities will be crucial. And since a portion of its contracts use a fixed pricing structure, being able to minimize capital expenditures will certainly help strengthen margins and tighten down on operating expenses.

Overall, ENGlobal presents an intriguing investment opportunity. The aggregate risk involved is moderate at best, and yet, the reward potential is substantial. ENGlobal should be viewed as a speculative buy with an abnormal amount of downside risk protection from its suppressed valuation. The probability of achieving an abnormal return on an initial investment is high. Therefore, I recommend buying ENGlobal at its current valuation.

Sources: TD Ameritrade, Google Finance, Yahoo Finance, Morningstar, FinViz, YCharts, sec.gov, and ENGlobal's Company Website.

No comments:

Post a Comment